9 Easy Facts About Paul B Insurance Described

Wiki Article

Paul B Insurance Things To Know Before You Buy

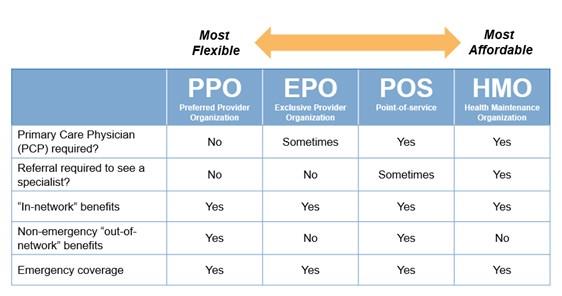

An HMO might need you to live or operate in its service area to be qualified for coverage. HMOs frequently give incorporated treatment and concentrate on avoidance and also wellness. A kind of strategy where you pay less if you utilize medical professionals, health centers, as well as other healthcare service providers that come from the plan's network.

A type of health plan where you pay much less if you use companies in the plan's network. You can make use of doctors, hospitals, and carriers outside of the network without a recommendation for an extra cost.

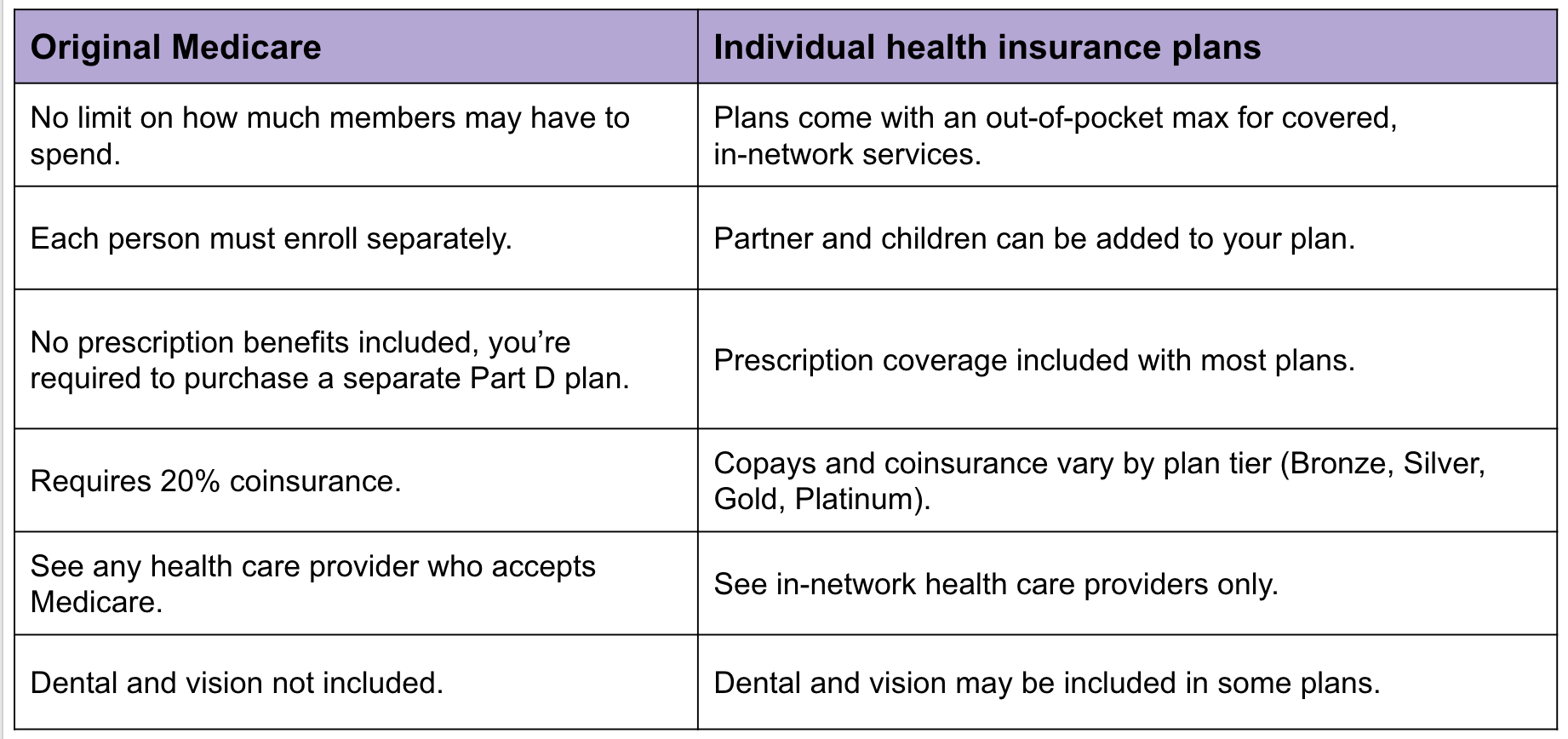

, and platinum. Bronze strategies have the least insurance coverage, as well as platinum plans have the many.

Any in your HMO's network. If you see a physician that is not in the network, you'll may have to pay the full bill yourself. Emergency situation services at an out-of-network health center should be covered at in-network rates, but non-participating doctors who treat you in the health center can bill you. This is the expense you pay every month for insurance coverage.

All about Paul B Insurance

A copay is a level charge, such as $15, that you pay when you get treatment. These costs differ according to your plan and they are counted toward your deductible.

Greater out-of-pocket prices if you see out-of-network medical professionals vs. in-network service providers, Even more documents than with various other plans if you see out-of-network service providers Any kind of in the PPO's network; you can see out-of-network physicians, however you'll pay more. This is the expense you pay monthly for insurance. Some PPOs may have an insurance deductible.

A copay is a level cost, such as $15, that you pay when you get care. Coinsurance is when you pay a percent of the fees for treatment, as an example 20%. If your out-of-network doctor bills even more than others in the area do, you may need to pay the balance after your insurance coverage pays its share.

Reduced costs than a PPO provided by the exact same insurance provider, Any kind of in the EPO's network; there is no coverage for out-of-network carriers. This is the cost you pay each month for insurance coverage. Some EPOs may have a deductible. A copay is a flat charge, such as $15, that you pay when you obtain treatment.

The Only Guide for Paul B Insurance

This is the expense you pay each month for insurance policy. Your plan may require you to pay the amount of a deductible before it covers treatment beyond preventive solutions.

We can't stop the unexpected from taking place, yet often we can shield ourselves and our family members from the worst of the monetary our website after effects. Selecting the right type as well as quantity of insurance is based upon your details circumstance, such as kids, age, lifestyle, as well as employment benefits. 4 kinds of insurance that the majority of economists suggest include life, health and wellness, car, and lasting impairment.

It consists of a fatality benefit and likewise a money worth part.

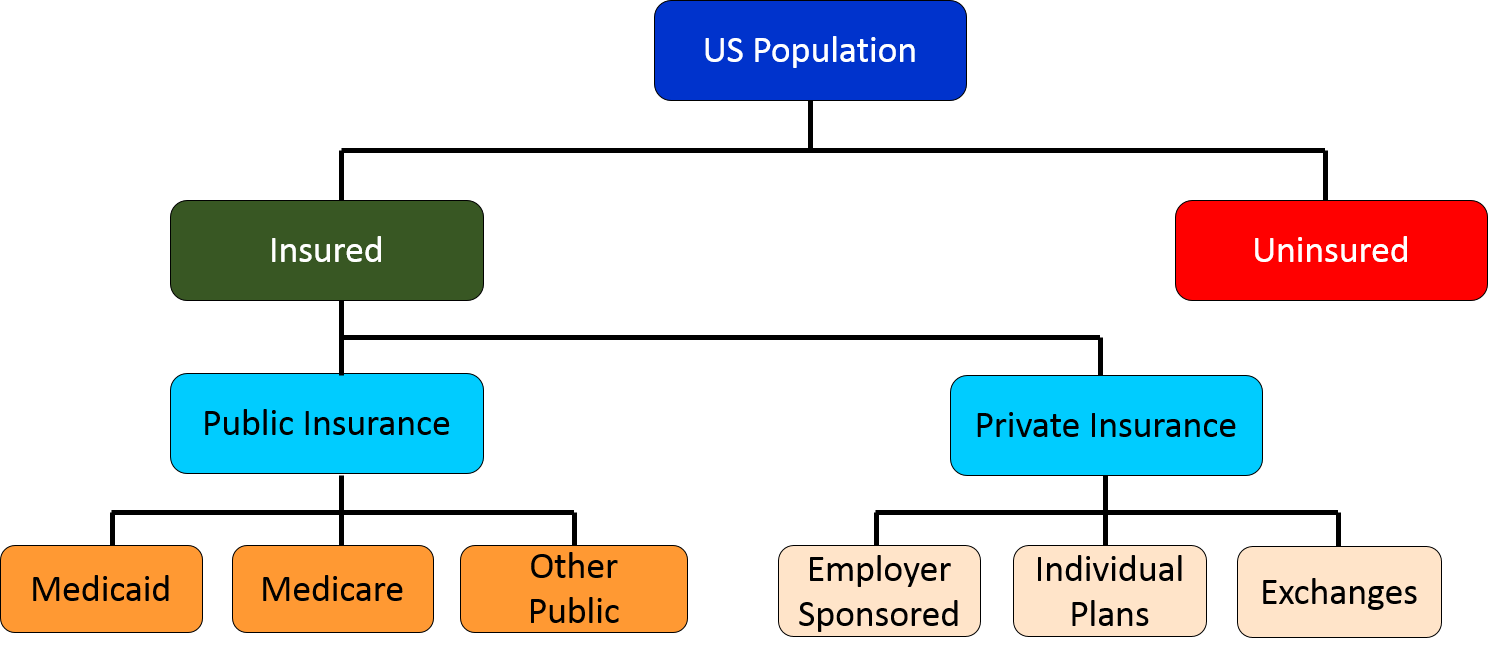

2% of the American populace was without insurance policy protection in 2021, the Centers for Illness Control (CDC) reported in its National Facility for Health Data. Greater than 60% obtained their protection with a company or in the private insurance industry while the remainder were covered by government-subsidized programs consisting of Medicare as well as Medicaid, veterans' benefits programs, as well as the government market established under the Affordable Treatment Act.

Everything about Paul B Insurance

According to the Social Safety Administration, one in four workers getting in the labor force will certainly come to be disabled before they get to the age of retired life. While health insurance coverage pays for a hospital stay and also clinical costs, you are often strained with all of the expenses that your income had covered.

This would be the very best alternative for securing cost effective impairment insurance coverage. If your company does not supply long-term protection, here are some points to consider before acquiring insurance policy by yourself: A plan that guarantees revenue substitute is ideal. Numerous plans pay 40% to 70% of your earnings. The expense of handicap insurance policy is based upon lots of factors, including age, way of life, as well as health.

Mostly all states need my blog vehicle drivers to have vehicle insurance and minority that don't still hold vehicle drivers economically in charge of any type of damage or injuries they trigger. Below are your alternatives when buying automobile insurance: Obligation insurance coverage: Spends for residential property damage and also injuries you create to others if you're at fault for a crash as well as additionally covers lawsuits expenses and judgments or negotiations if you're filed a claim against since of a vehicle accident.

Company protection is often the ideal alternative, yet if that is inaccessible, obtain quotes from numerous companies as several offer price cuts if you purchase more than one type of coverage.

Some Of Paul B Insurance

When contrasting plans, there are a couple of variables you'll intend to consider: network, cost and benefits. Check out each strategy's network and figure out if your preferred providers are in-network. If your doctor is not in-network with a plan you are thinking about yet you wish to remain to see them, you might wish to consider a various plan.

view publisher siteTry to find the one that has the most advantages as well as any particular physicians you need. Most companies have open registration in the autumn of each year. Open up enrollment is when you can transform your benefit choices. You can change health and wellness plans if your company provides more than one plan.

You will need to pay the premiums yourself. ; it might cost less than individual health insurance policy, which is insurance policy that you get on your very own, as well as the benefits may be better. If you certify for Federal COBRA or Cal-COBRA, you can not be refuted coverage as a result of a medical condition.

You might need this letter when you obtain a new group health plan or apply for a private health and wellness plan. Private health plans are strategies you acquire on your own, for on your own or for your family members.

Paul B Insurance Fundamentals Explained

Some HMOs provide a POS strategy. Fee-for-Service strategies are typically believed of as standard plans.

Report this wiki page